When it comes to car accidents, most states are “fault states” or “tort states.” In these jurisdictions, a person injured in a car accident has the right to file a claim with the insurance company of the party at fault. You may think that it would be easier and more convenient to be able to file a claim with your own insurance company and get the compensation you need without having to worry about fault for the accident. Depending on where you live, there are coverages available from your own insurance company that takes care of at least some of your expenses from your accident.

Medical Payments Coverage

More commonly known as Med Pay, medical payments coverage pays for any medical expenses resulting from injuries to you or your passengers as a result of an accident. Med Pay only covers medical bills, but it does not take fault into consideration. In other words, even if the accident was your fault, or if the fault is ambiguous or nearly equal, you can still benefit from Med Pay. There are very few states that require drivers to purchase Med Pay, but it is available in some states as an option.

Personal Injury Protection

In no-fault states, where it is not the responsibility of the party who caused the accident to pay damages to the injured party, drivers are required to carry coverage for personal injury protection. PIP is similar to Med Pay in that it covers your expenses regardless of who is at fault for the accident. However, while Med Pay only covers medical bills, PIP offers more comprehensive coverage, reimbursing you for things such as lost wages if you cannot work after an accident and funeral costs if a loved one dies as a result. Drivers in fault states are not required to carry PIP coverage, but it is optional coverage available for purchase in most states.

Uninsured/Underinsured Motorist Insurance

Unlike the other examples, uninsured and underinsured motorist coverage only pays out in a specific circumstance. While the laws of most states require that drivers take out insurance on their vehicles, not everyone complies. Those who do may purchase only the minimum coverage required. You can only make an uninsured or underinsured motorist claim if the other driver either has no insurance at all or does not have enough to pay all the damages related to your accident. Your coverage then kicks in to make up the difference. Some states require uninsured or underinsured motorist coverage.

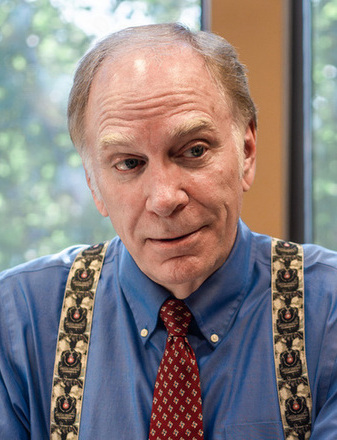

As our personal injury lawyer from Daniel E. Stuart, P.C. can attest to, if you have these coverages, you can make a claim with your own insurance. Unfortunately, that doesn’t necessarily mean a fair payout.